michigan use tax exemption form

However if provided to the purchaser in electronic format a signature is not required. Below are forms for prior Tax Years starting with 2021.

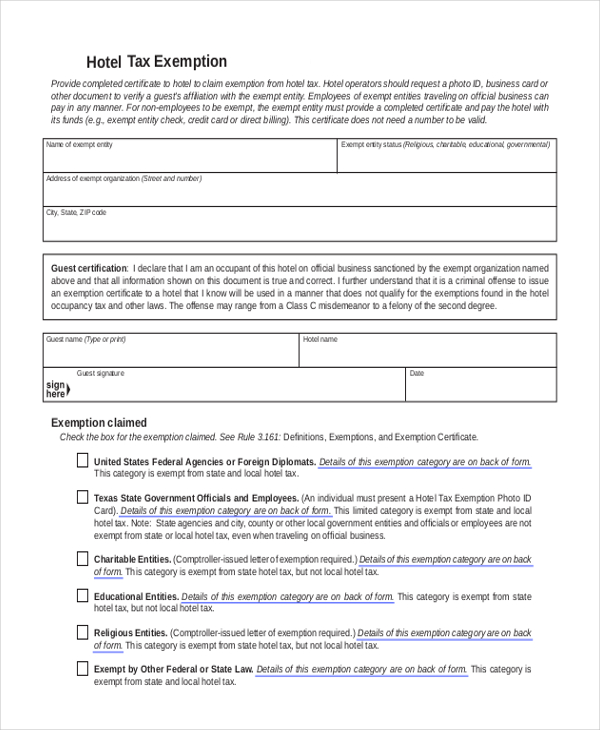

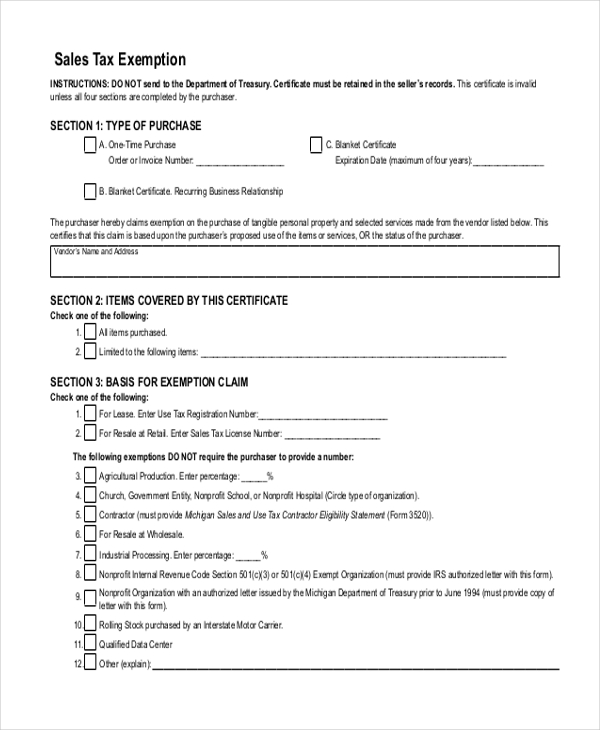

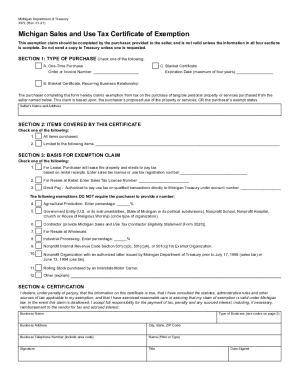

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

TYPE OF PURCHASE DA.

. Tax Exemption Certificate for Donated Motor Vehicle. As a purchaser it is your responsibility to ensure that both you and your transaction qualifies for tax-exempt status. Michigan Department of Treasury Form 3372 Rev.

The form can be completed by adding the vendor and date. Electronic Funds Transfer EFT Account Update. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury.

Michigan Sales and Use Tax Contractor Eligibility Statement. It is important to note that tax-exempt status is only granted on qualified sales. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions.

All claims are subject to audit. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers. 31 2022 can be e-Filed in conjunction with a IRS Income Tax Return.

Certificate must be retained In the sellers records. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Tax Exemption Certificate for Donated Motor Vehicle.

03-16 Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS. Tax Exemption Certificate for Donated Motor Vehicle. All elds must be.

Sales Tax Return for Special Events. If you are looking for the latest and most special shopping information for Sales Tax Form For Michigan results we will bring you the latest promotions along with gift information and information about Sale Occasions you may be interested in during the year. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Michigan Sales and Use Tax Contractor Eligibility Statement. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. Michigan Sales Tax Exemption This form is used to exempt the university from sales tax on purchases.

Michigan Sales and Use Tax Certificate of Exemption. Michigan Sales and Use Tax Contractor Eligibility Statement. Electronic Funds Transfer EFT Account Update.

It is used in conjunction with the IRS determination letter documenting the universitys exempt status. Either the letter issued by the Department of Treasury prior to June 1994or. The state of Michigan has only one form which is intended to be used when you wish to purchase tax-exempt items such as prescription medicines.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Apply for or renew license. DO NOT sand to tha Department of Treasury.

Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax. Michigan Sales and Use Tax Certificate of Exemption. Promotions can be up to 63 with limited quantities.

Ad pdfFiller allows users to edit sign fill and share all type of documents online. Promotions can be up to 88 with limited quantities. These back taxes forms can not longer be e-Filed.

Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. Instructions for completing Michigan Sales and Use T ax Certi cate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on quali ed transactions. Michigan is uncommon in having only one Tax exemption certificate.

2021 Aviation Fuel Informational Report - - Sales and Use Tax. Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a. TYPE OF PURCHASE One-time purchase.

2022 Aviation Fuel Informational Report - - Sales and Use Tax. This certificate is invalid unless all four sections are completed by the purchaser. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury.

Sales Tax Return for Special Events. Details on how to only prepare and print a Michigan 2022 Tax Return. TYPE OF PURCHASE One-time purchase.

If you are looking for the latest and most special shopping information for Sales Tax Form For Michigan results we will bring you the latest promotions along with gift information and information about Sale Occasions you may be interested in during the year. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. In order to claim exemption the nonprofit organization must provide the seller with both.

Certificate must be retained in the Sellers Records. PdfFiller allows users to edit sign fill and share all type of documents online. A Michigan resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them.

Please keep in mind that the form should be used in accordance with SPG 50203. Apply for or renew permit or certification. This certlflcate Is Invalid unless all four sections are completed by the purchaser.

Michigan Department of Treasury Form 3372 Rev. All claims are subject to audit. Electronic Funds Transfer EFT Account Update.

May use this form to claim exemption from Michigan sales and use tax on qualified transactions. Find or apply for employment. All claims are subject to audit.

2020 Aviation Fuel Informational Report - - Sales and Use Tax. The Michigan Sales and Use Tax Exemption Certificate can be used to purchase any of the tax exempt items in Michigan. Seller must keep this form in either digital or paper.

Michigan does not issue tax-exempt numbers so sellers must have this form in order for you to be granted your tax-exempt status. Michigan State Income Tax Forms for Tax Year 2022 Jan. Michigan Department of Traasury 3372 Rav.

Therefore we prioritize updating the latest information so that. Therefore we prioritize updating the latest information so that. Sales Tax Return for Special Events.

Do Business with the City. It allows suppliers to know that you are legally. Certificate must be retained in the Sellers Records.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigan Sales and Use Tax Certificate of Exemption. Pay fine bill or tax.

Evidence of nonprofit eligibility. This certificate is invalid unless all four sections are completed by the purchaser.

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

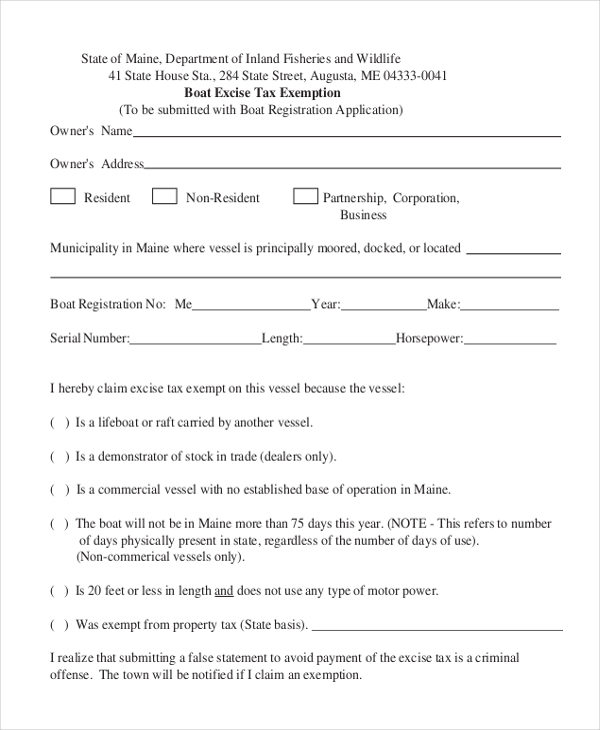

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

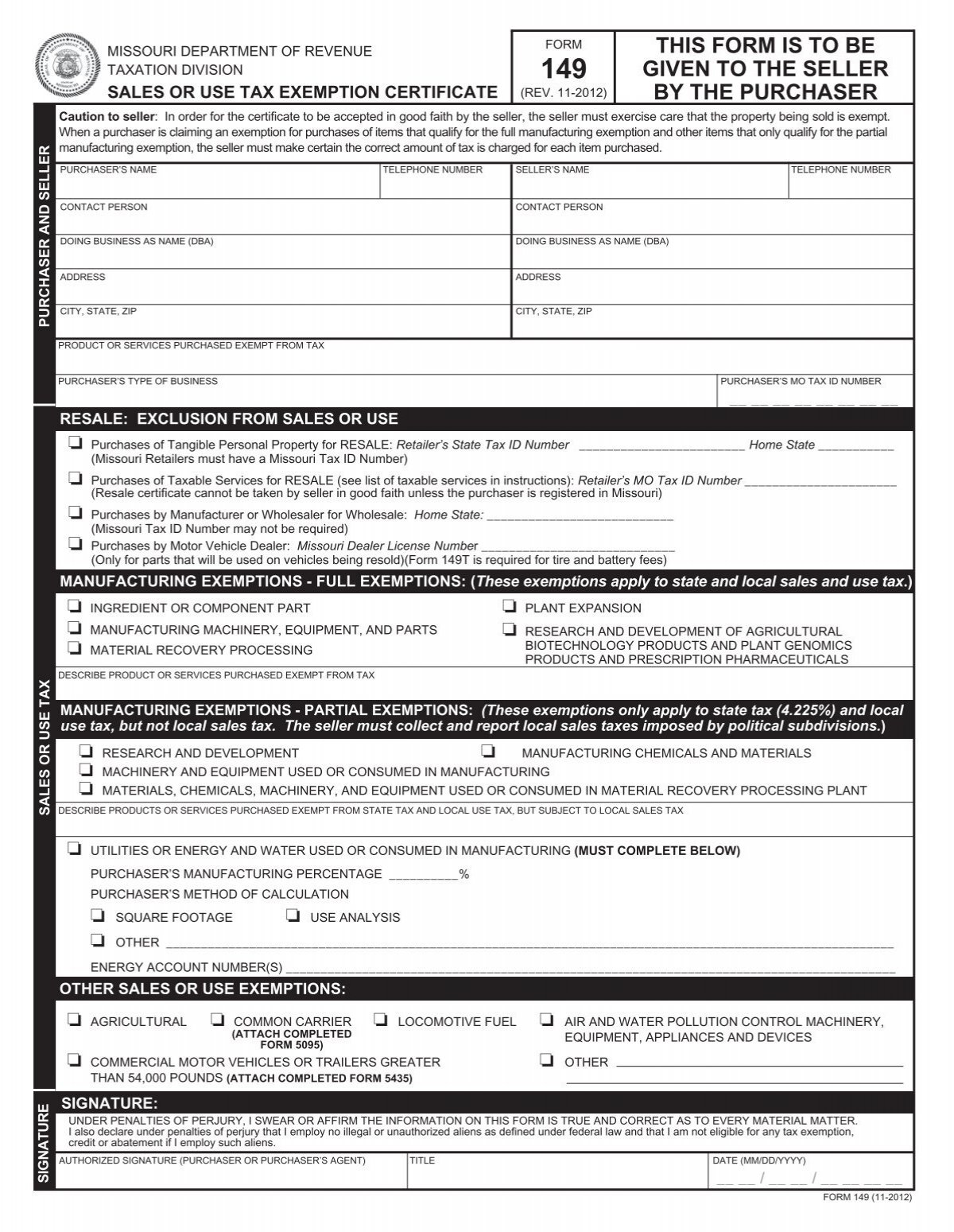

Form 149 Sales And Use Tax Exemption Certificate Missouri

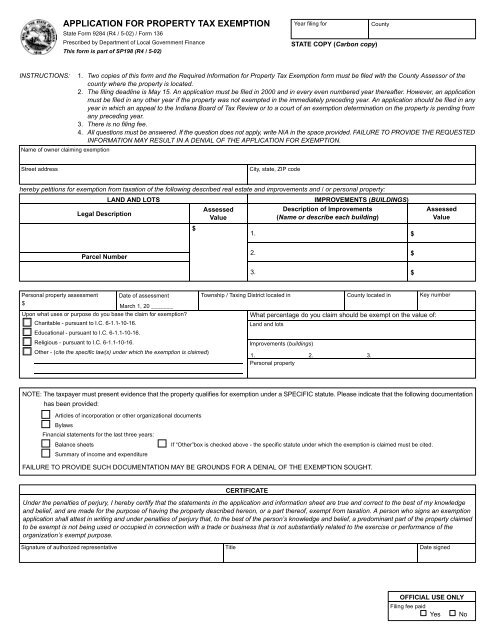

Form 136 Application For Property Tax Exemption

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Resale Certificate Fill Out And Sign Printable Pdf Template Signnow

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Download Policy Brief Template 40 Brief Executive Summary Ms Word

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales And Use Tax Certificate Of Exemption

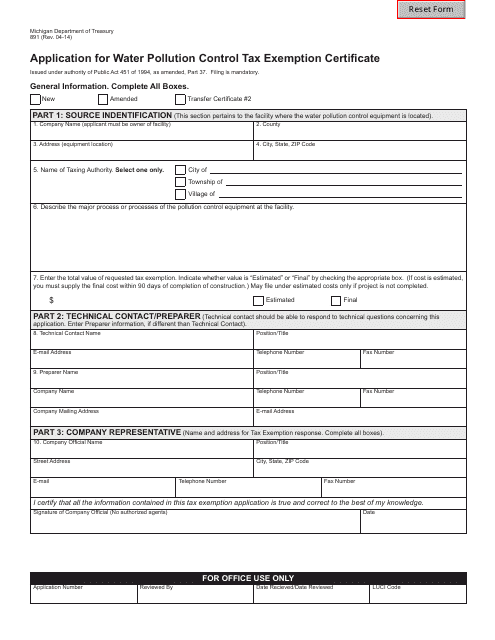

Form 891 Download Fillable Pdf Or Fill Online Application For Water Pollution Control Tax Exemption Certificate Michigan Templateroller